July 14, 2023

•

5 min read

US Bank Account That Accepts Your Address Abroad

Finally, there's a US bank account that recognizes your home address abroad. In this article, we walk you through the process of how to get your own SDFCU bank account.

Rafael Bracho

Insurance Expert

Introduction:

US Bank Account That Accepts Your Address Abroad

So many expats abroad have been shackled to a friend or family member’s home address—for long enough. If you’re tired of sensitive financial information being sent to a relative’s address, then you’re in luck. Now, through the American Citizens Abroad nonprofit organization, expats finally have a bank that recognizes your home address in another country.

Applying for this bank account is quick and easy, and we’re going to walk you through the process so you know exactly what to expect. Just follow the instructions below and soon you’ll have a bank account that works with your lifestyle abroad.

Apply for an ACA Membership

Step 1: Apply for an American Citizens Abroad membership. American Citizens Abroad is a 501(c)(4) nonprofit organization.They tackle issues facing expats and expat communities abroad—in this particular case, banking solutions.

*To apply for ACA, click here.

Apply for an SDFCU Account Step 2. Now that you’re an ACA member, you can apply for a State Department Federal Credit Union (SDFCU) account through your ACA membership.

*To apply, click here.

Required Documents Step 3. Don’t worry, we found applying to be really fast and easy, but you’ll need some information and documents if you’re going to apply for an SDFCU account:

- Government issued ID/Drivers License/State ID/Passport (with your current address)

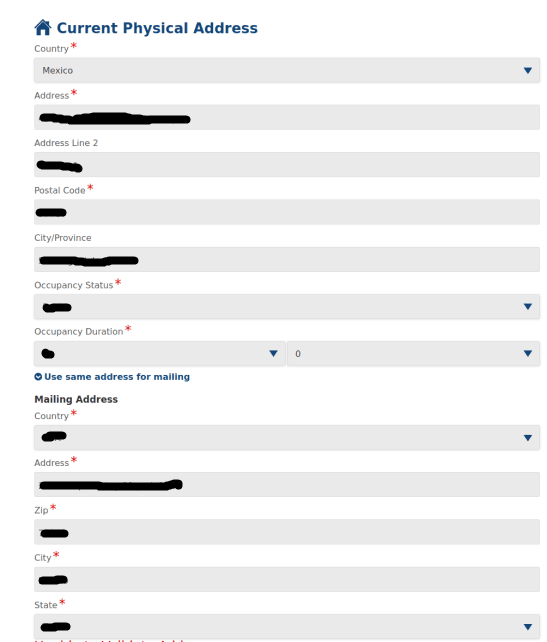

- Physical Address (where you’re living abroad)

- Mailing Address (the address you’ve been using in the U.S.)

- Social Security Number

- Date of Birth

Choose Your Account Type: Step 4. For example, do you want the typical savings and checking account?

- *Note: If you maintain $2500, you can select the Advantage Checking

- *Note: If you maintain $25,000, the Privilege Checking

Optional SMS Verification Step 5. This step is optional, but a lot of people like the idea of having a two-step verification that double-checks their account’s actions on their phone.

Ability to Select Mexico as your Residence Step 6. Basically, you set your international mailing address (where you live abroad) as your new mailing address.

Fund your account Step 7. I chose ACH transfer from my American bank account. You can fund your account from any account you already have.

Wait for Account Opening Step 8. You might have to wait for an account to open. This takes a few business days, but you’ll get that notification email soon enough.

Proof of Residence Step 9. You might be asked for a final step: a proof of residence step. In my case, I had to upload:

- a. Proof of Residence (I used a utility bill for my apartment from Sapasma—from the Mexican government—which was not in my name)

- b. Residency Card for Your Country Abroad

Conclusion

US Bank Account That Accepts Your Address Abroad

This is a new type of bank account that recognizes that human beings can and do move from their home country to another. Now you with an ACA membership you can apply for an SDFCU bank account. Now, you can finally be recognized as an expat by your bank—having an international residence tied to your bank account, instead of having to piggyback off a friend’s home address as so many expats have had to do over the years.

Rafael Bracho

Insurance Expert & Writer

For several years, Rafael has been crafting articles to help expats and nomads in their journey abroad.

Get Protected While Living Abroad

Found this article helpful? Make sure you have the right insurance coverage too. Get instant quotes for international health, life, and travel insurance.

Takes 2 minutes • Compare multiple providers • Expert advice